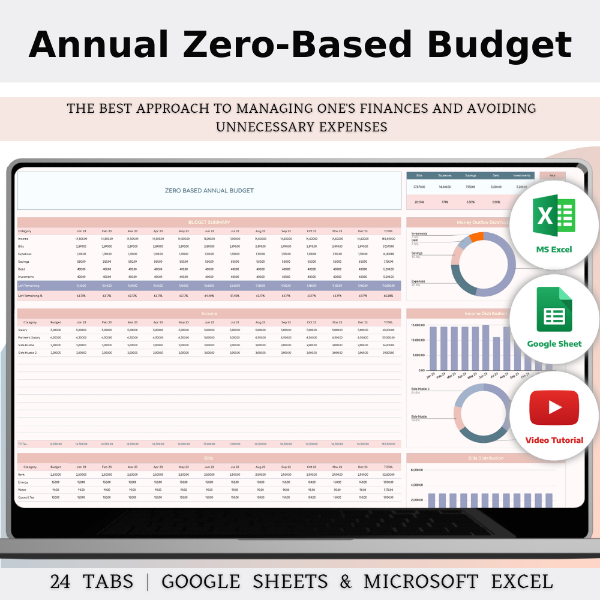

Annual Zero-Based Budget Spreadsheet Template In Excel & Google Sheets

$10.99

& Instant Download

Payment Methods:

Item description from the seller

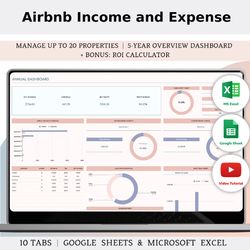

Ultimate Zero-Based Budget Spreadsheet Excel & Google Sheets

A Zero-Based Budget Spreadsheet is a budget table with a zero balance. In such a table, every income and expense is planned and tracked so that the balance equals zero. This means that every unit of income must be allocated to expenses, investments, or savings, so that there are no unallocated funds at the end of the budget period. This approach helps people manage their finances more consciously and avoid unnecessary expenses.

WHAT’S INCLUDED IN THE PURCHASE?

- Video Tutorial

- 20-Page Quick Start Guide

- 4 Templates of Spreadsheets

- 1 Sample Excel Spreadsheet with Mock Data

- Excel Spreadsheet with Empty Data

- Sample Google Sheets Spreadsheet with Mock Data

- Google Sheets Spreadsheet with Empty Data

- Editable in Google Sheets and Microsoft Excel

- Compatible with MAC, PC, Phones, or Tablets

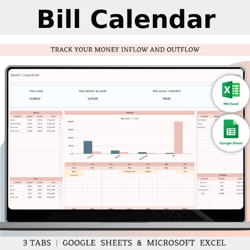

- 24 Spreadsheet Tabs

TABS:

- Instructions

- Settings

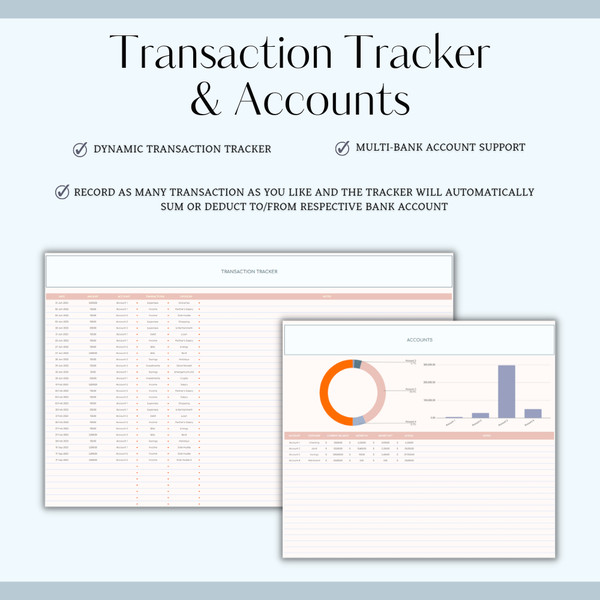

- Accounts

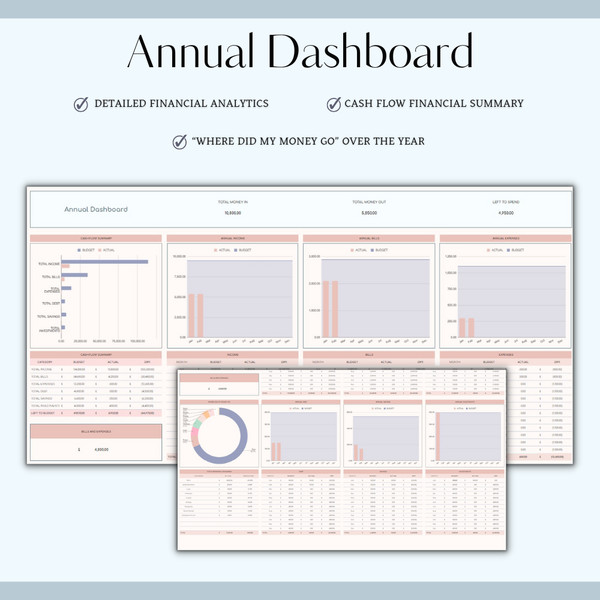

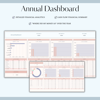

- Annual Dashboard

- Transaction Tracker

- Annual Report

- 12 Tabs (Jan – Dec)

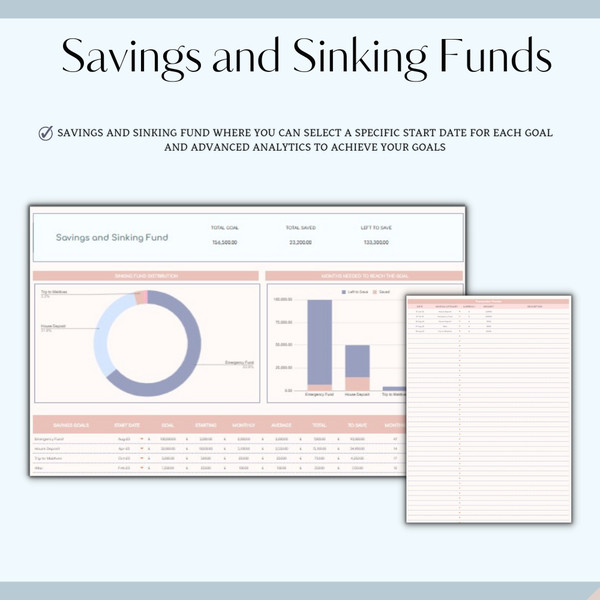

- Savings & Sinking Fund

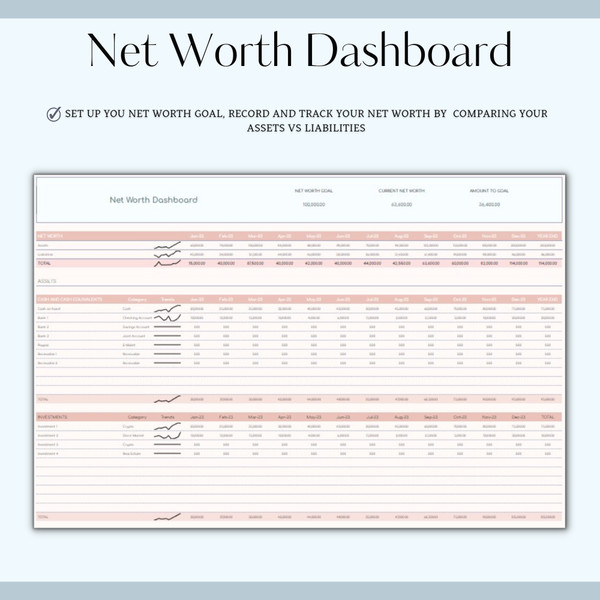

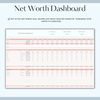

- Net Worth

- Debt Management

- Payments Schedule

- Debt Dashboard

- Payment Tracker

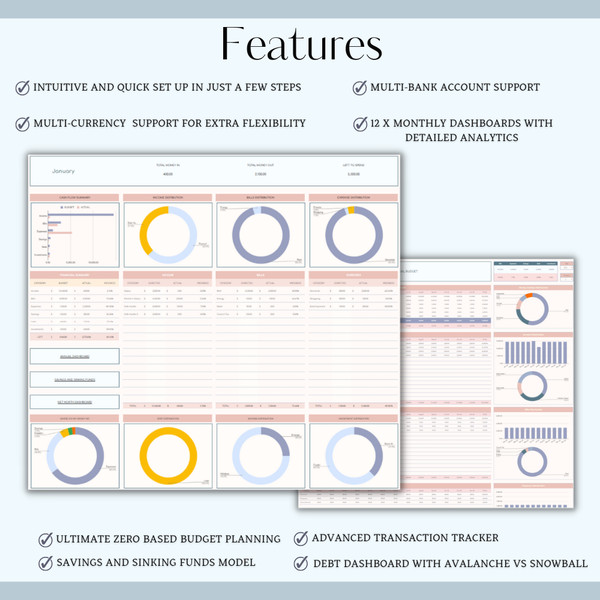

Features

- Intuitive and quick set up in just a few steps

- Multi-currency support for extra flexibility

- Multi-bank account support

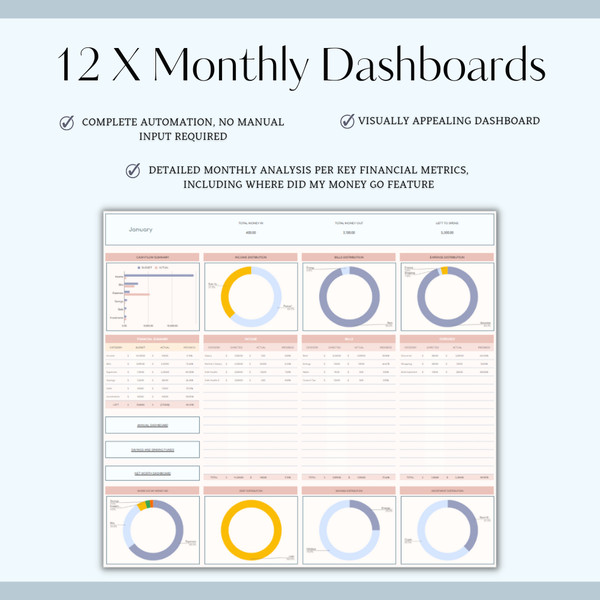

- 12 x monthly dashboards with detailed analytics

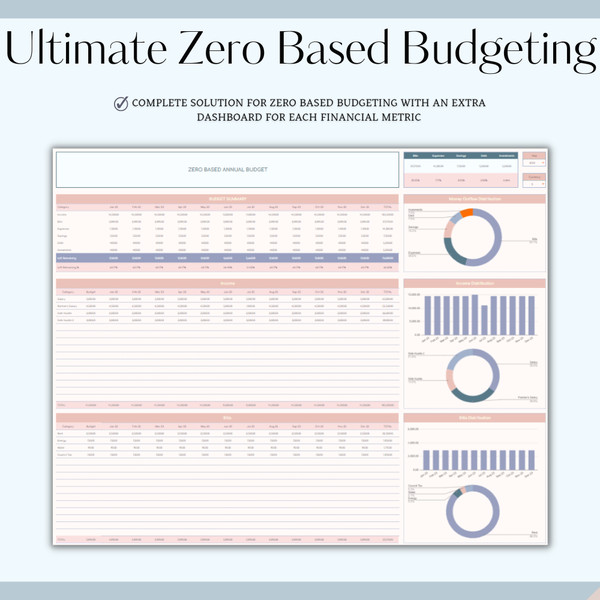

- Ultimate zero based budget planning

- Savings and sinking funds model

- Advanced transaction tracker

- Debt dashboard with avalanche vs snowball

- Settings: Tailor your budgeting experience by adjusting preferences and personal details.

- Accounts: Centralize and manage all your financial accounts, ensuring accurate transaction records.

- Annual Dashboard: Gain a comprehensive yearly snapshot of your financial health, highlighting key metrics and goals.

- Transaction Tracker: Record daily transactions, categorize spending, and maintain a detailed transaction history.

- Annual Report: Generate a detailed yearly financial report, providing insights into income, expenses, and savings patterns.

- 12 Tabs (Jan – Dec): Monthly breakdowns for in-depth budgeting, allowing precise planning for each month.

- Savings & Sinking Fund: Strategically plan and track progress toward savings and sinking fund goals.

- Monitor your overall financial standing by calculating assets, liabilities, and net worth.

- Debt Management: Organize and optimize your debt payoff strategy, empowering you to take control of your financial obligations.

- Payments Schedule: Stay on top of financial commitments with a clear overview of upcoming payments and due dates.

- Debt Dashboard: Visualize and manage your debts efficiently, helping you make informed decisions about your financial future.

- Payment Tracker: Log and review your payment history for a comprehensive view of your financial transactions.

More from this shop

Listed on 14 March, 2024