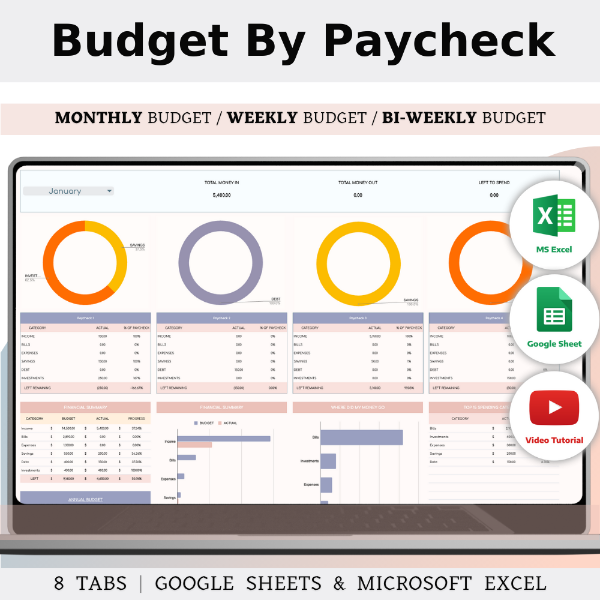

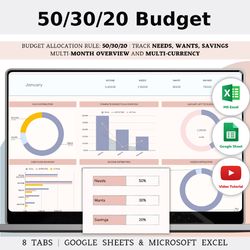

Monthly Paycheck Budget Spreadsheet Template In Excel & Google Sheets, Biweekly And Weekly Budget

$4.99

& Instant Download

Payment Methods:

Item description from the seller

WHAT’S INCLUDED IN THE PURCHASE?

- Video Tutorial

- 20-Page Quick Start Guide

- 4 Templates of Spreadsheets

- 1 Sample Excel Spreadsheet with Mock Data

- 1 Excel Spreadsheet with Empty Data

- 1 Sample Google Sheets Spreadsheet with Mock Data

- 1 Google Sheets Spreadsheet with Empty Data

- Editable in Google Sheets and Microsoft Excel

- Compatible with MAC, PC, Phones, or Tablets

- 8 Spreadsheet Tabs

TABS:

- Settings

- Annual Dashboard

- Transaction Tracker

- Monthly Overview

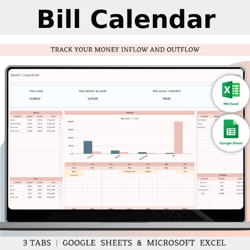

- Smart Calendar

- Savings & Sinking Fund

- Debt Management

- Payments Schedule

Features:

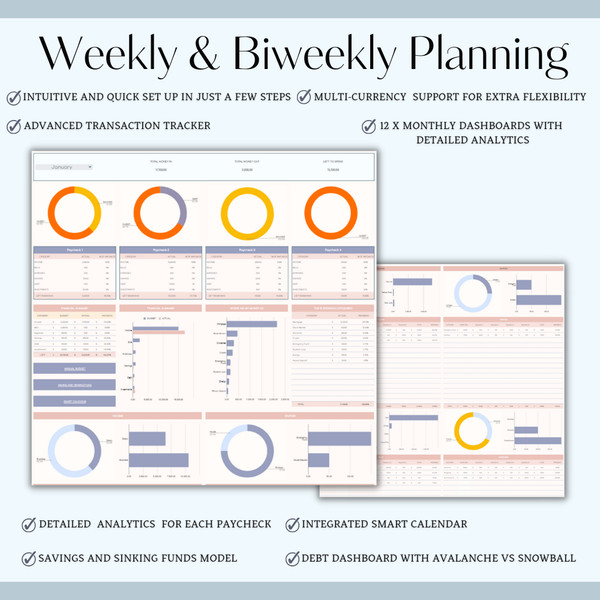

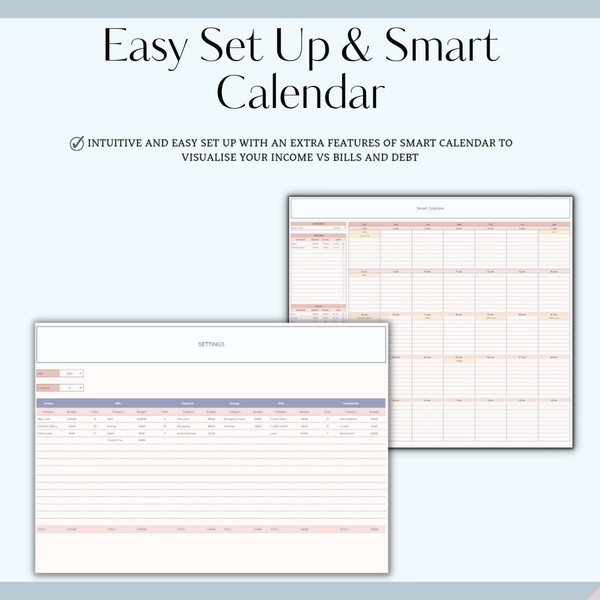

- Intuitive and quick set up in just a few steps

- Multi-currency support for extra flexibility

- Advanced transaction tracker

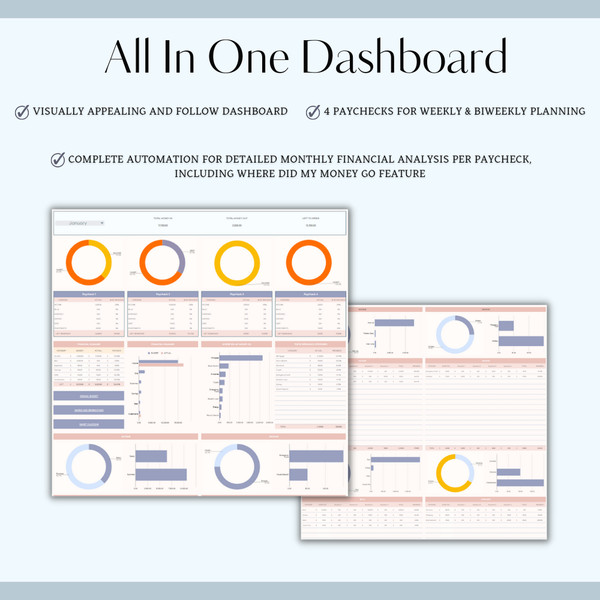

- 12 x monthly dashboards with detailed analytics

- Detailed analytics for each paycheck

- Savings and sinking funds model

- Integrated smart calendar

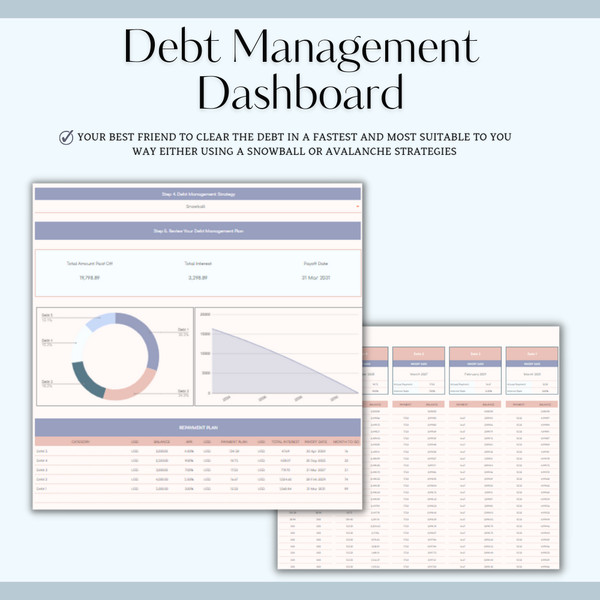

- Debt dashboard with avalanche vs snowball

-

Settings:

- Personalize your financial tool: Adjust currency preferences, time periods, and other settings.

- Customize categories and labels for transactions.

-

Annual Dashboard:

- Get an overview of your financial health for the entire year.

- Track key metrics, goals, and milestones.

- Visualize income, expenses, and savings trends.

-

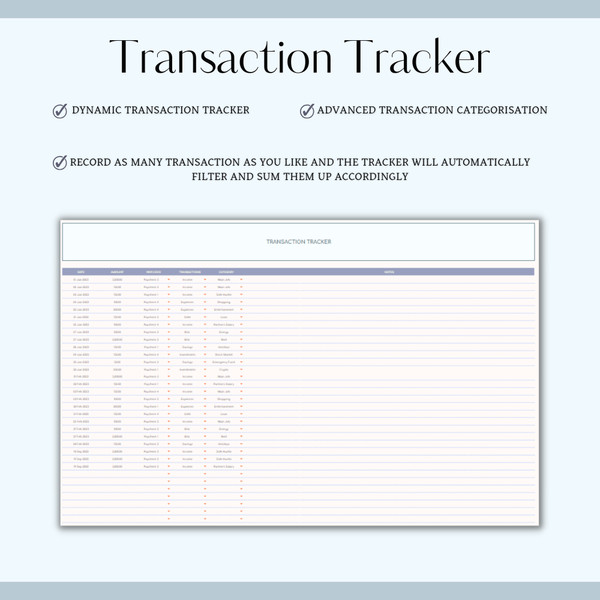

Transaction Tracker:

- Record and categorize income and expenses throughout the year.

- Monitor real-time updates on your financial transactions.

- Easily edit or delete entries for accurate tracking.

-

Monthly Overview:

- Detailed review of finances for the month.

- Analyze specific monthly trends, income, and expenses.

- Plan and adjust your budget on a month-to-month basis.

-

Smart Calendar:

- View financial events and milestones on a calendar layout.

- Set reminders for bill payments, savings goals, and other financial tasks.

-

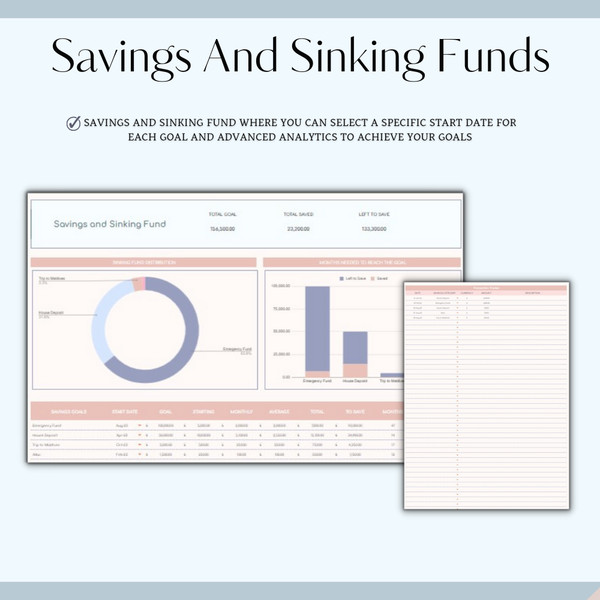

Savings & Sinking Fund:

- Set savings goals and track progress over time.

- Allocate funds to sinking funds for planned future expenses.

-

Debt Management:

- Keep an organized record of your debts.

- Track repayments, interest rates, and outstanding balances.

-

Payments Schedule:

- Visualize a schedule for upcoming payments and financial obligations.

- Set reminders for due dates and avoid late fees.

YOU WILL NEED:

- A device to access Google Sheets or Microsoft Excel

- A Google Account (if editing through Google Sheets)

- Microsoft Excel (if editing through Excel)

- Basic computer knowledge

HOW IT WORKS:

- Purchase (instant download)

- Upload the PDF file (access to Google Sheet)

- Download the Excel template

- Open the spreadsheet (start planning!)

More from this shop

Listed on 14 March, 2024