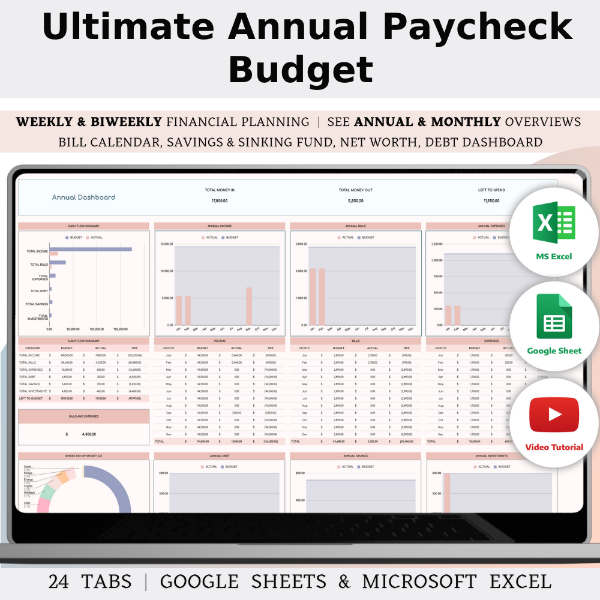

Annual Budget By Paycheck Spreadsheet Template Excel And Google Sheets, Biweekly And Weekly Paycheck

Template Annual Budget By Paycheck Spreadsheet Excel And Google Sheets

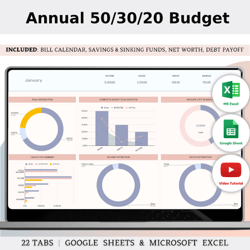

Annual Budget By Paycheck Spreadsheet Template – your ultimate tool for financial empowerment. With its user-friendly interface and customizable features, our template is perfect for beginners and seasoned budgeters alike. Say goodbye to financial stress and hello to financial freedom as you take charge of your budget, whether it’s based on biweekly, weekly, or monthly paychecks.

WHAT’S INCLUDED IN THE PURCHASE?

- Video Tutorial

- 20-Page Quick Start Guide

- 4 Templates of Spreadsheets

- 1 Sample Excel Spreadsheet with Mock Data

- Excel Spreadsheet with Empty Data

- Sample Google Sheets Spreadsheet with Mock Data

- Google Sheets Spreadsheet with Empty Data

- Editable in Google Sheets and Microsoft Excel

- Compatible with MAC, PC, Phones, or Tablets

- 24 Spreadsheet Tabs

TABS:

- Instructions

- Settings

- Annual Dashboard

- Annual Report

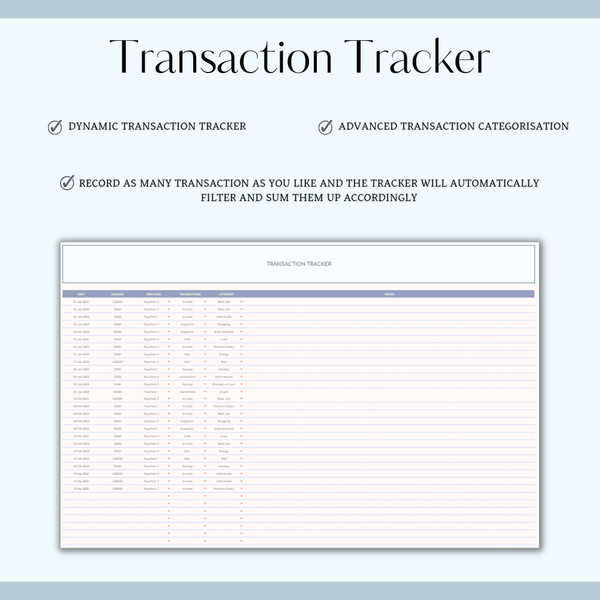

- Transaction Tracker

- 12 Tabs Monthly

- Smart Calendar

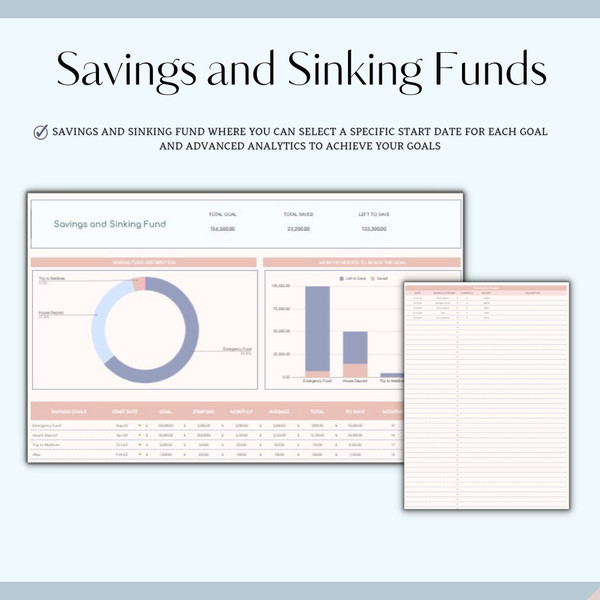

- Savings & Sinking Fund

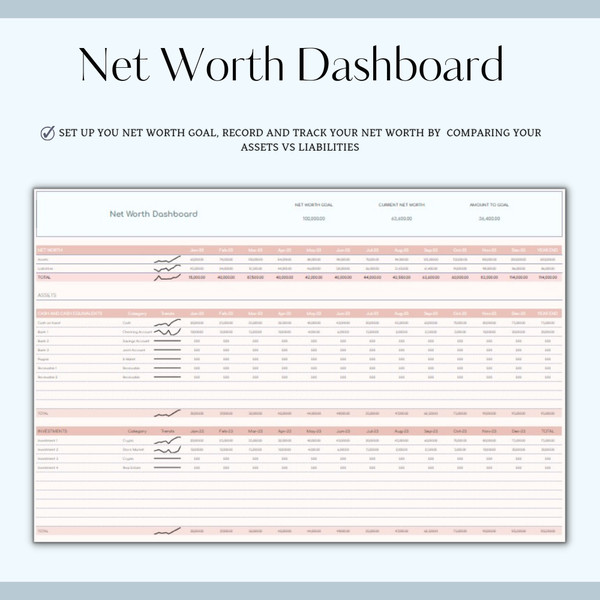

- Net Worth

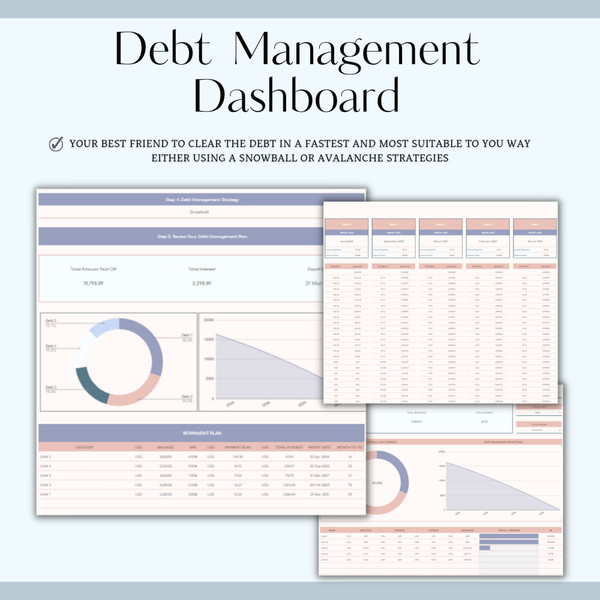

- Debt Management

- Payments Schedule

- Debt Dashboard

- Payment Tracker

Features:

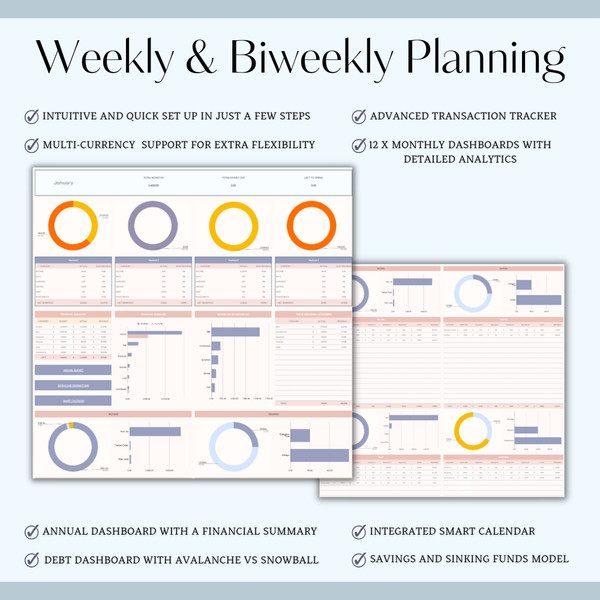

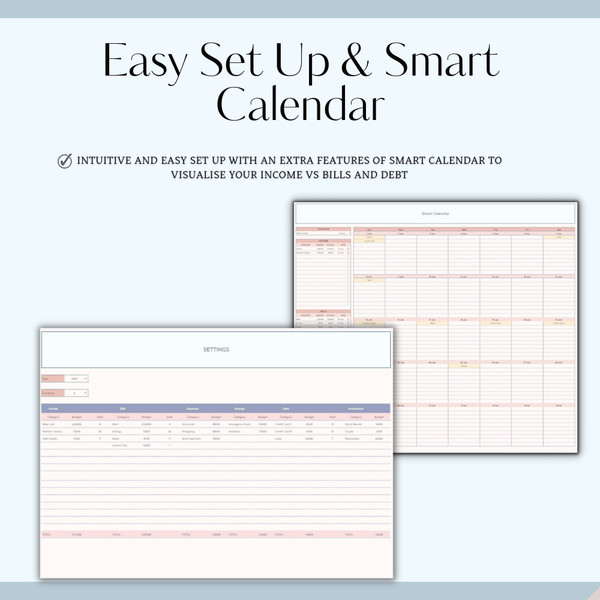

1. Settings:

– Personalize your financial tool: Adjust currency, time periods, and other preferences.

– Customize categories and labels: Tailor them to fit your specific financial needs.

– Set up default options: Define default settings for various features in line with your preferences.

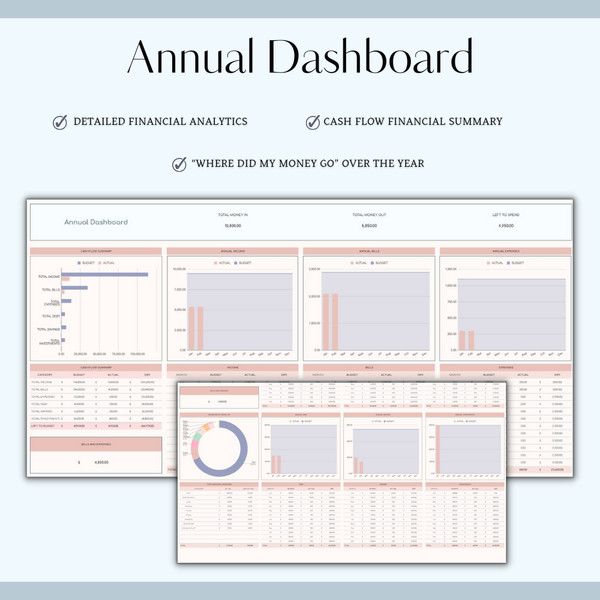

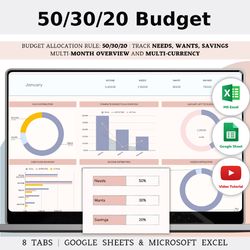

2. Annual Dashboard:

– Display total annual income.

– Showcase annual expenses, savings, and discretionary spending.

– Visual charts for a quick overview.

3. Annual Report:

– Detailed breakdown of annual income and expenses.

– Comparison with budgeted values for insights.

4. Transaction Tracker:

– Log each transaction, including date, category, amount, and description.

– Categorize transactions for better tracking.

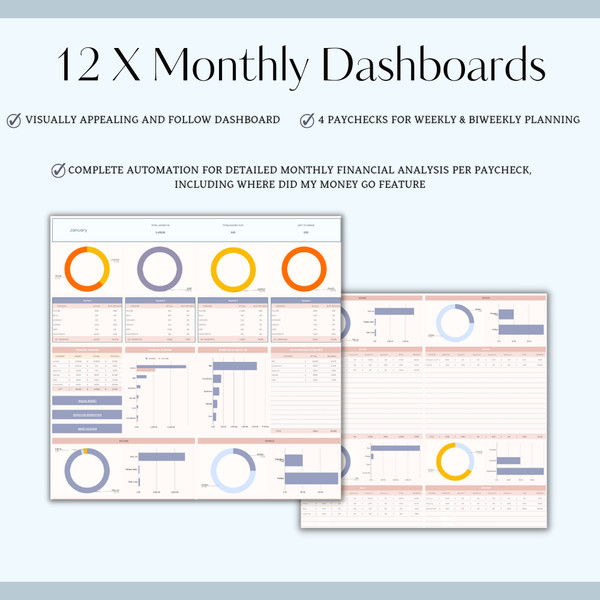

5. 12 Tabs Monthly:

– Individual tabs for each month with income and expense tracking.

– Monthly summary for quick comparisons.

6. Smart Calendar:

– Mark payday and bill due dates.

– Visualize cash flow events for the month.

7. Savings & Sinking Fund:

– Track progress toward savings goals.

– Allocate funds to sinking funds for planned expenses.

8. Net Worth:

– Calculate net worth by assessing assets and liabilities.

– Monitor net worth growth over time.

9. Debt Management:

– Log and categorize outstanding debts.

– Visual representation of debt distribution.

10. Payments Schedule:

– Detailed schedule for planned payments.

– Highlight important payment due dates.

11. Debt Dashboard:

– Overview of current debts and their status.

– Track progress in debt reduction.

12. Payment Tracker:

– Log all payments made, including dates and amounts.

– Track remaining balances for each payment.